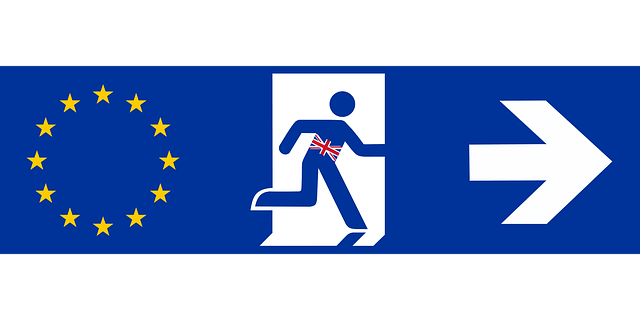

Business Loans and Brexit – What Does it All Mean?

With the UK’s exit from the European Union scheduled to start next year, the future of the economy is at stake. Brexit will affect every single business in every sector, especially if it trades with EU countries. The pound is already losing value, and international investors are waiting for the market to stabilise before taking the risk. Nobody knows what the future looks like, but this period of economic uncertainty does make banks and lenders nervous – which is bad news for any business needing finance.

Banks are reducing lending, which means securing any kind of loan from a mortgage to a business loan is now harder than it was before the vote. Virgin Money announced shortly after the Brexit vote that it will be delaying small business lending and no longer expanding into the unsecured lending market. However, the impact of Brexit won’t be truly felt until negotiations begin, and the big question is whether we will remain in the single market or not. What does it all mean for British businesses?

EU Freedoms

The main principle of the EU is freedom. Freedom of movement is one of the main things British voters were voting against, however the Union also allows free movement of capital. This enables European investors to invest in British businesses, and British businesses to raise funds in other countries if needed. Abandoning the free movement of capital could have a negative impact on business.

Higher Trading Costs

The majority of SMEs in the UK export to countries within the EU, and will want to continue to do so. However, business owners are now likely to face higher trade costs, whether we strike a Norway-style deal or leave the single market altogether. While this may open opportunities to export further afield, it is always easier to trade with our closest neighbours.

Less Competition for Banks

Without continental banks and overseas European investment, the only option SMEs will have is British banks. This immediately means these financial institutions have less competition, and will be able to overcharge SMEs with bulging interest rates. When competition dwindles, corporations can take advantage of customers which we have seen in all sectors.

Economic Uncertainty

Perhaps the largest problem for SMEs – and the entire nation’s economy – is the uncertainty which prompts currency volatility. An instable economy hits SMEs harder, because they are seen to be of higher risk to lenders. Banks will shift lending from SMEs to larger businesses, putting pressure on smaller businesses to find alternative funds.

If you own a small or medium sized business and are having trouble finding a business loan, take a look at our alternative finance options.